PIR Calculator

Check out the information below to find out more about your PIR and if you're on the right rate.

What is the prescribed investor rate?

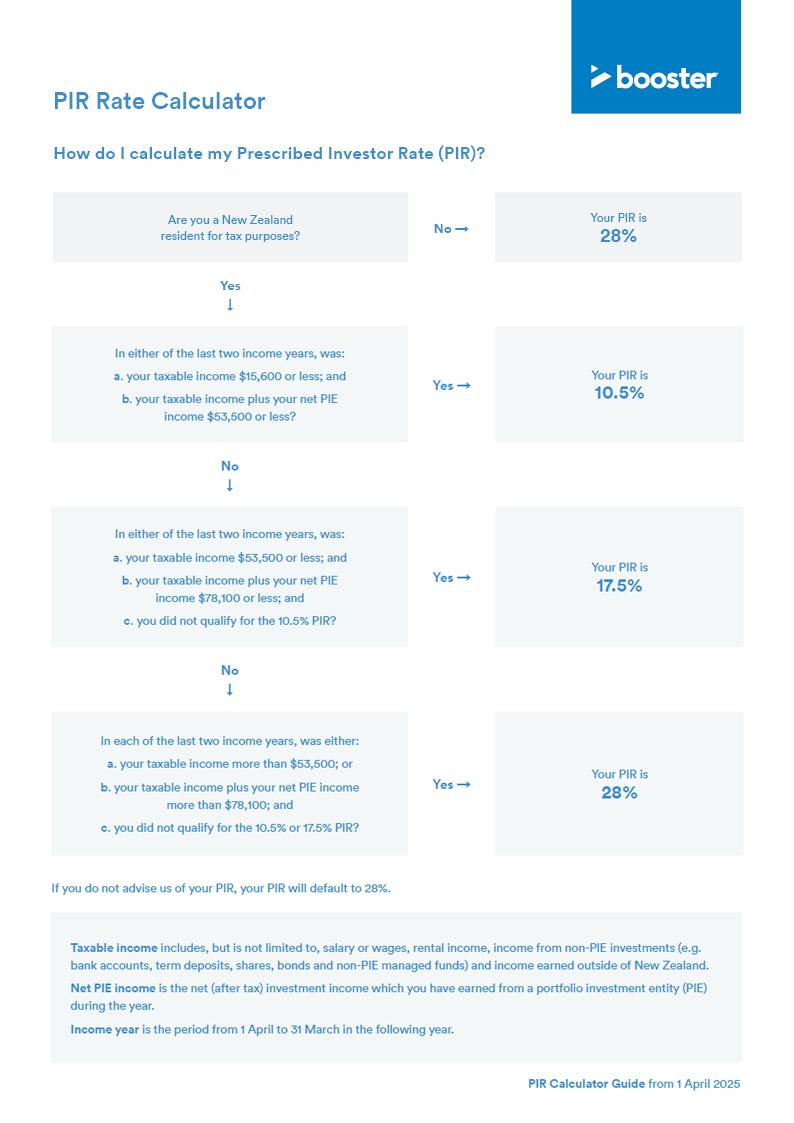

Your prescribed investor rate (PIR) determines how much tax you pay on your investment earnings.

Why is it important?

Which rate applies to you depends on your overall income from all sources.

You need to tell us your prescribed investor rate (PIR) or we'll use the default rate of 28%.

If you don't choose the correct rate, you could be paying more tax or less tax than you need to.

Over or underpaying your PIR tax

For tax year 1 April 2020 to 31 March 2021 (and later tax years)

If you've been taxed at a higher PIR rate but you're eligible for a lower PIR rate, you might be eligible for a refund. You'll need to contact IRD to work this out.

And, if you've been taxed at a lower PIR rate but should be on a higher PIR rate, you'll need to file a tax return as you may owe some tax.

For tax year 1 April 2019 to 31 March 2020 (and earlier tax years)

If you were taxed at a higher PIR rate but were eligible for a lower PIR rate, you can't claim a refund of the overpaid tax.

And, if you were taxed at a lower PIR rate than you should have been, you'll need to file a tax return as you might owe some tax.

Check your PIR

You can check and update your prescribed investor rate (PIR) by following these steps:

- log in to mybooster

- go to the 'My Details' section

- view your details by clicking the person icon in the top right hand corner.

We're here to help

Call us on 0800 336 338

8am - 8pm Monday to Friday