In the aftermath of destructive weather events, such as Cyclone Gabrielle, storms and floods, many affected businesses are left, taking stock of how to – and whether they even should – rebuild after the intense damage caused by destructive flooding.

Chris Westbury, Booster Associate Director, Direct Investments, says the decimation of Hawke’s Bay’s productive lands may have some investors questioning how such risks are managed in agricultural investments, such as Booster’s Private Land and Property Fund (PLPF).

“Given the effects of these huge weather events – and its possible increase in regularity due to global warming – it’s a reasonable question to ask,” says Chris.

“However, when considering investments for our portfolios, we always apply a robust risk strategy to provide resilience and diversification to help mitigate these uncertainties – and that includes weather-driven risk.” he says.

“At some stage, some of these assets – like PLPF’s vineyards, orchards and hop farms – may be affected by natural disasters and extreme weather events. So, we also ask a series of questions to assess the type of risks that come along with events, such as what we’ve seen with Cyclone Gabrielle.”

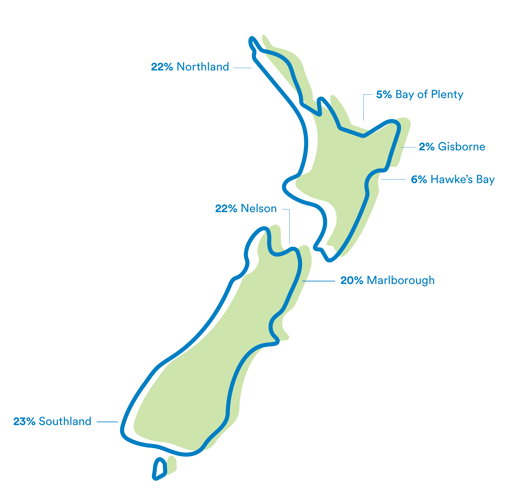

Geographic diversification

Do we have properties in the region already, and what does that do to our geographical diversification?

PLPF invests in properties all over the country, which means that if one area is hit by localised weather, the entire portfolio is not at risk. The benefits of geographical diversification were demonstrated during the recent cyclone.

“Even though much of the North Island was affected by the cyclone, the South Island was relatively unscathed,” says Chris.

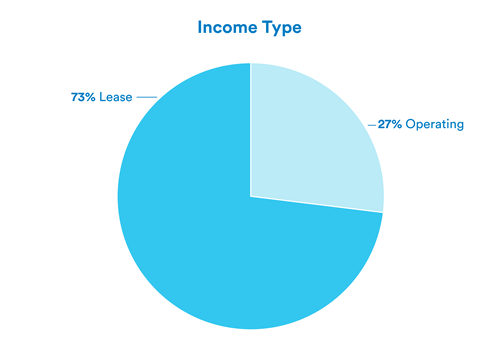

Operating risk

Are we going to take the crop/operations risk, or do we want to lease the property out to an operator?

In the event crops on PLPF properties are damaged, the risk is generally passed to the property operator, as the majority of Booster properties are leased. In this scenario Booster is still exposed to the risk the operator cannot meet its lease obligations. However, in some circumstances, we take crop risk where we believe the economic benefit in the long run outweighs any short-term volatility or other risks associated with operating the property.

“This means our investors generally don’t bear any direct financial loss if a flood or cyclone destroys a season’s crops,” says Chris.

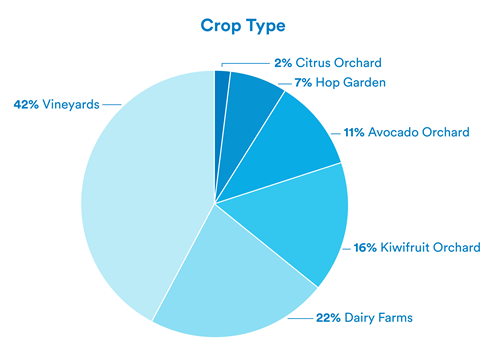

Land Use

What is the land used for and how exposed is the fund to that land use?

This example isn’t weather related, but it is another consideration that is driven by the whims of Mother Nature.

“We want to ensure we aren’t over exposed to any one event or risk that may affect a certain type of crop or land use. For example, disease or pest risk – like the PSA virus that devastated the kiwifruit industry in 2010-11 – is another risk area we manage at a portfolio level,” he says.

“For instance, we’ve invested across six different land uses, with an objective to further expand this and reduce our exposure to vineyards.”

Trusted operating partners

Who is our operating partner? Are they resilient enough to weather a bad season or two, and how much debt do they have on their balance sheet?

We work closely with our operating partners, undertaking rigorous, regular credit checks to ensure there is a robust history of paying outgoings. Booster also spreads the exposure across a range of fund partners.

“We partner for the long term and choose operators who we believe will be operating in 10-20 years’ time as opposed to having a short-term focus on maximising every lease term”, says Chris.

“Additionally, we look for operating partners have an attitude of treating the property as though they are the owners. Properties that are well cared for by these operators are more likely to gain or preserve capital value, via incremental improvements in operations and robust repairs and maintenance programmes.”

Chris says, as well as considering each property on its own merits and how it fits into the portfolio, the Booster investment team is always working behinds the scenes to ensure investors are kept up to date and the portfolio is running smoothly.

"We aren’t immune to weather events or other unforeseen adverse impacts. It’s how we manage that risk to ensure that, in the long run, we can fulfil our investment goals for our investors,” he says.

-

Booster Investment Management Ltd is the manager and issuer of the Booster Investment Scheme 2, Private Land and Property Fund (Fund). The Fund’s Product Disclosure Statement is available at www.booster.co.nz.